Net non interest margin formula

This means that 64 cents on every dollar of sales is used to pay for variable costs. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio.

Net Interest Income Financial Edge

The income statement formula consists of the three different formulas in which the first formula states that the gross profit of the company is derived by subtracting the Cost of Goods Sold from the total Revenues and the second formula states that the Operating Income of the company is derived by subtracting the Operating Expenses from the total gross profit arrived.

. We can represent contribution margin in percentage as well. Net Profit Margin 2017. Here we can see that the company is growing in terms of profit and revenue from 2017 to 2018.

The net profit margin is 55. Shows Growth Trends. Buying stocks on margin generates the interest expense most commonly associated with individual investing.

Why Net Profit Margin Is Important. There are two main reasons why net profit margin is useful. According to our formula Christies operating margin 36.

As you can see Christies operating income is 360000 Net sales all operating expenses. Typically expressed as a percentage net profit margins show how much of each dollar collected by a. The gross margin represents the percent of total.

Gross margin is a companys total sales revenue minus its cost of goods sold COGS divided by total sales revenue expressed as a percentage. Unit contribution margin per unit denotes the profit potential of a product or activity from the. Net Profit Margin 2017 051.

Using the above formula Company XYZs net profit margin would be 30000 100000 30. In which case it will incur significant interest expenses which will drive down its net profit margin. Net Profit Margin Formula.

Interest expense for personal finance. Net profits Net sales x 100 Net profit margin. Net profit margin is an easy number to examine when reviewing the profit of a company over a certain period.

The net profit margin can be radically. Only 36 cents remains to cover all non-operating expenses or fixed costs. Here we discuss the formula to calculate net profit after tax examples advantages and disadvantages.

Net Profit Margin Net Income Net Revenue. After paying all the operating expenses non-operating expenses interest on a loan. This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm.

It is measured using specific ratios such as gross profit margin EBITDA and net profit margin. Net profit margin is the ratio of net profits to revenues for a company or business segment. Using taxable investment accounts -- not.

The net sales part of the equation is gross sales minus all sales deductions such as sales allowances.

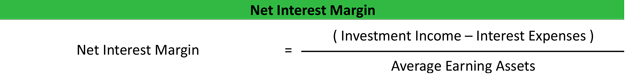

Net Interest Margin Nim Formula Example Calculation Analysis

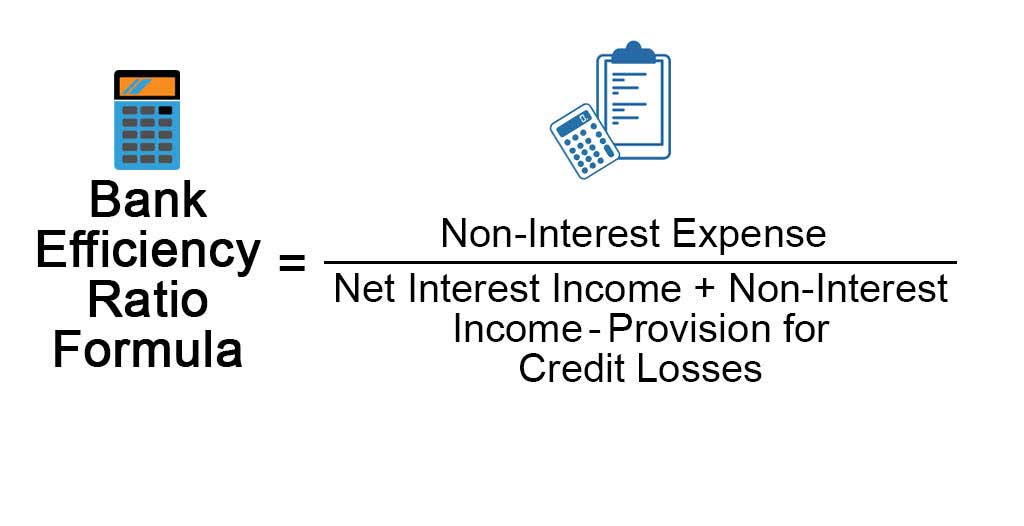

Bank Efficiency Ratio Formula Examples With Excel Template

Net Profit Margin Formula And Ratio Calculator Excel Template

Samples Of Academic Cover Letters Http Career Ucsf Edu Grad Students Postdocs Career Planning Academic Jobs Applying Acade Lettering Cover Letter Online Jobs

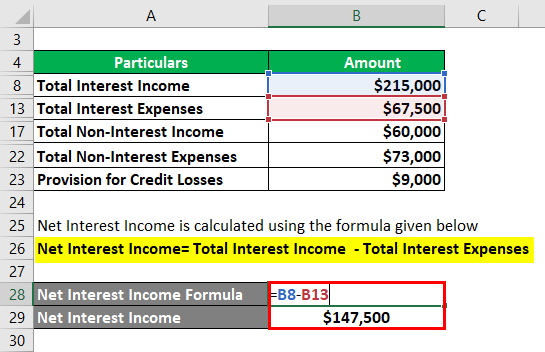

Net Interest Income Overview And How To Calculate It

Net Interest Income Nii Formula And Calculator Excel Template

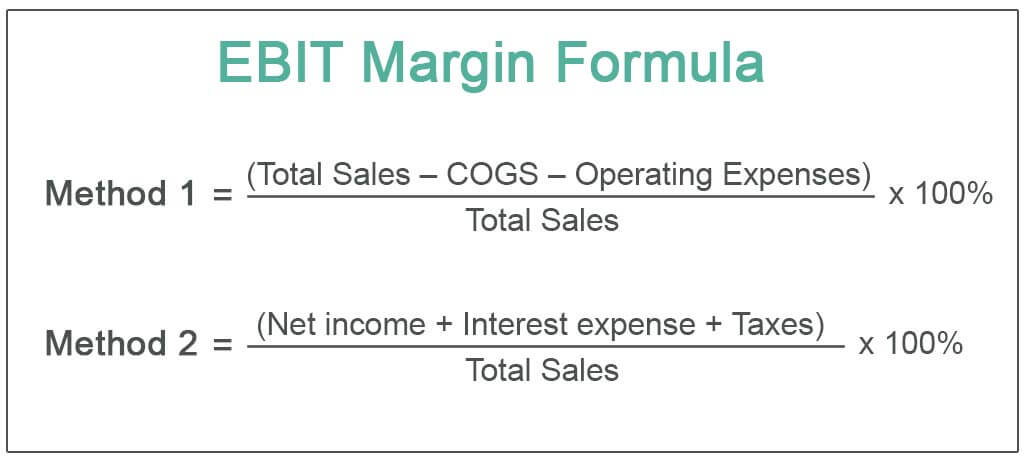

Ebit Margin Formula Excel Examples How To Calculate Ebit Margin

/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

Ebit Meaning Importance And Calculation Accounting Education Bookkeeping Business Small Business Bookkeeping

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Net Interest Income Financial Edge

Net Interest Income Nii Formula And Calculator Excel Template

Net Interest Income Financial Edge

Net Income Formula Calculation And Example Net Income Income Accounting Education

Non Interest Income Of Banks Definition Examples And List

Bank Efficiency Ratio Formula Examples With Excel Template

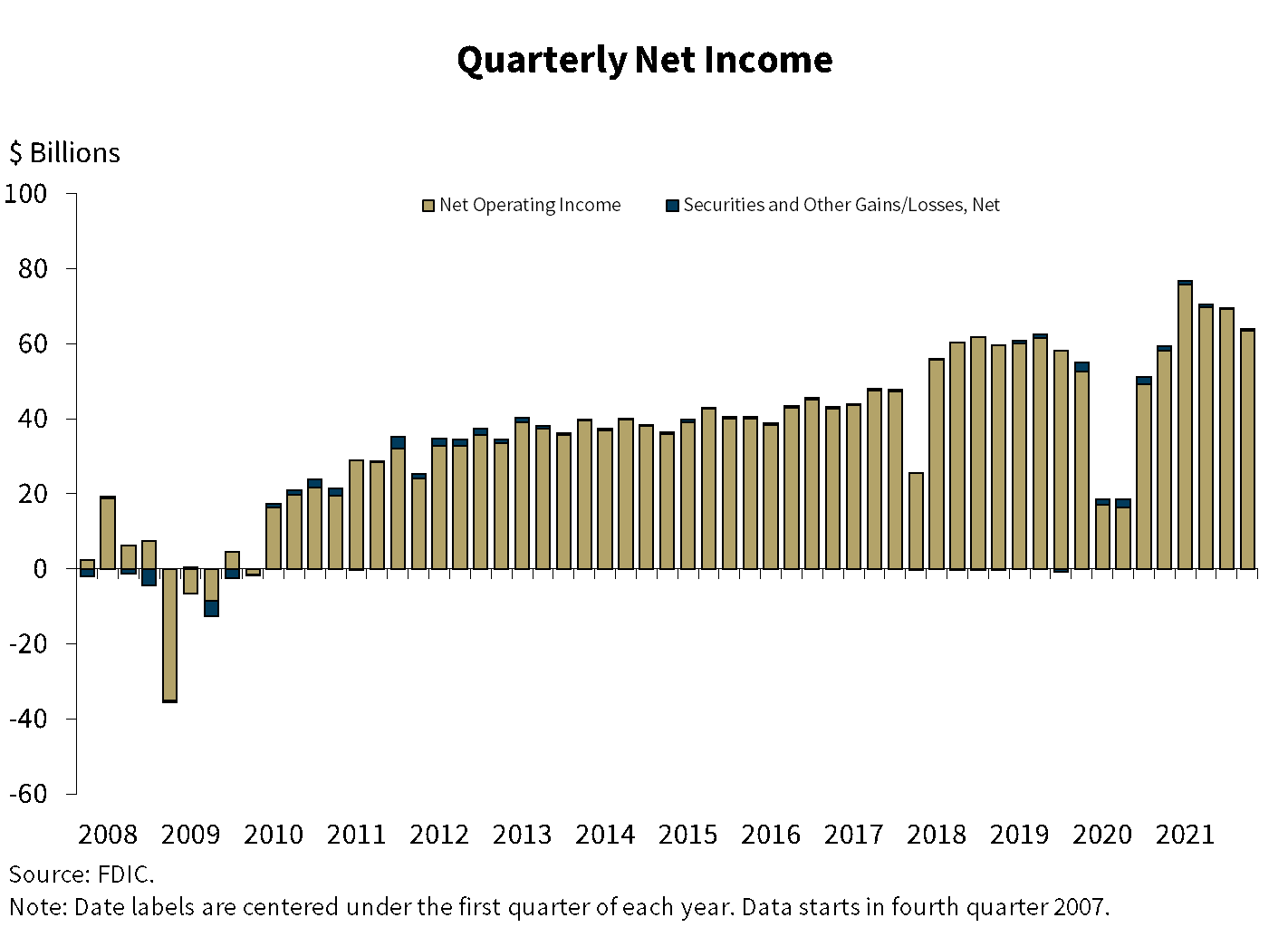

Fdic Pr 22 20222 3 1 2022

Komentar

Posting Komentar